Liquidity Automation and Vendor Management

for the Produce Supply Chain

The only treasury and payment automation solution for the produce industry.

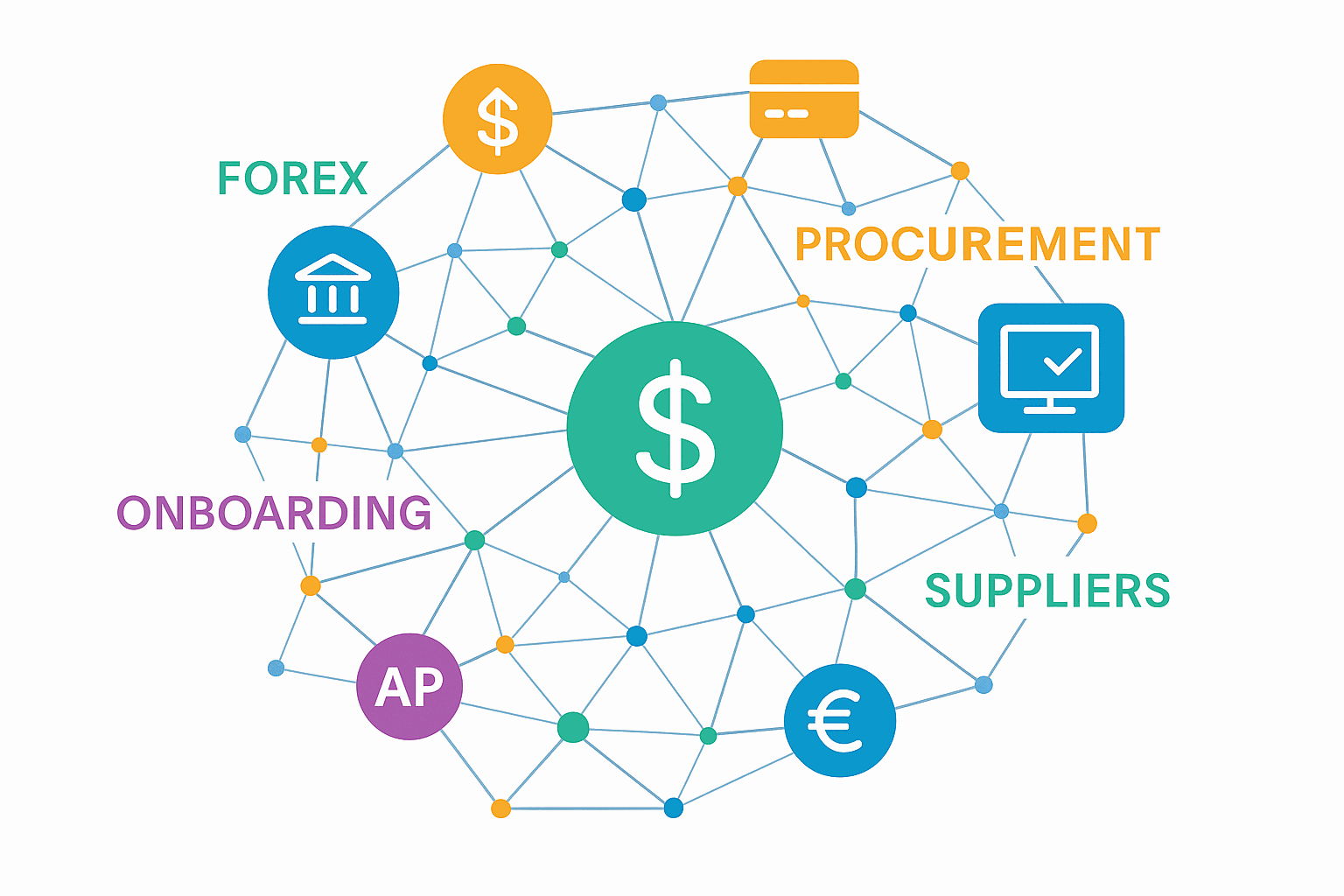

We help produce businesses manage their cash, onboard suppliers, and stay compliant.

Over time, businesses accumulate workarounds and makeshift processes to get work done. Reserva Pay consolidates all AP and vendor management operations into a single platform.

AP workflows for Produce

Designed for the unique speed, seasonality, and vendor complexity of the fresh produce supply chain, ensuring seamless coordination from PO to payment.

PACA trust compliance built-in

Automatically structure transactions to comply with PACA Trust rules, securing grower rights and building confidence with suppliers.

End-to-end cash flow visibility

Real-time dashboards and forecasting tools give finance teams control over receivables, payables, and funding gap

Instant vendor onboarding

Streamlined onboarding with food safety certifications, PACA verification, tax collection forms, and document management to reduce setup time and errors.

FX and cross-border payments in one place

Send same-day payments to Mexico and other countries, manage multi-currency exposure, and avoid high bank fees with integrated FX tools.

AP Automation

-

Automated invoice capture and data extraction

-

Smart payment scheduling based on due dates and cash position

-

Multi-level approval workflows with role-based permissions

-

Centralized dashboard for reviewing, editing, and confirming payments

-

Audit trail and real-time notifications for payment status and exceptions

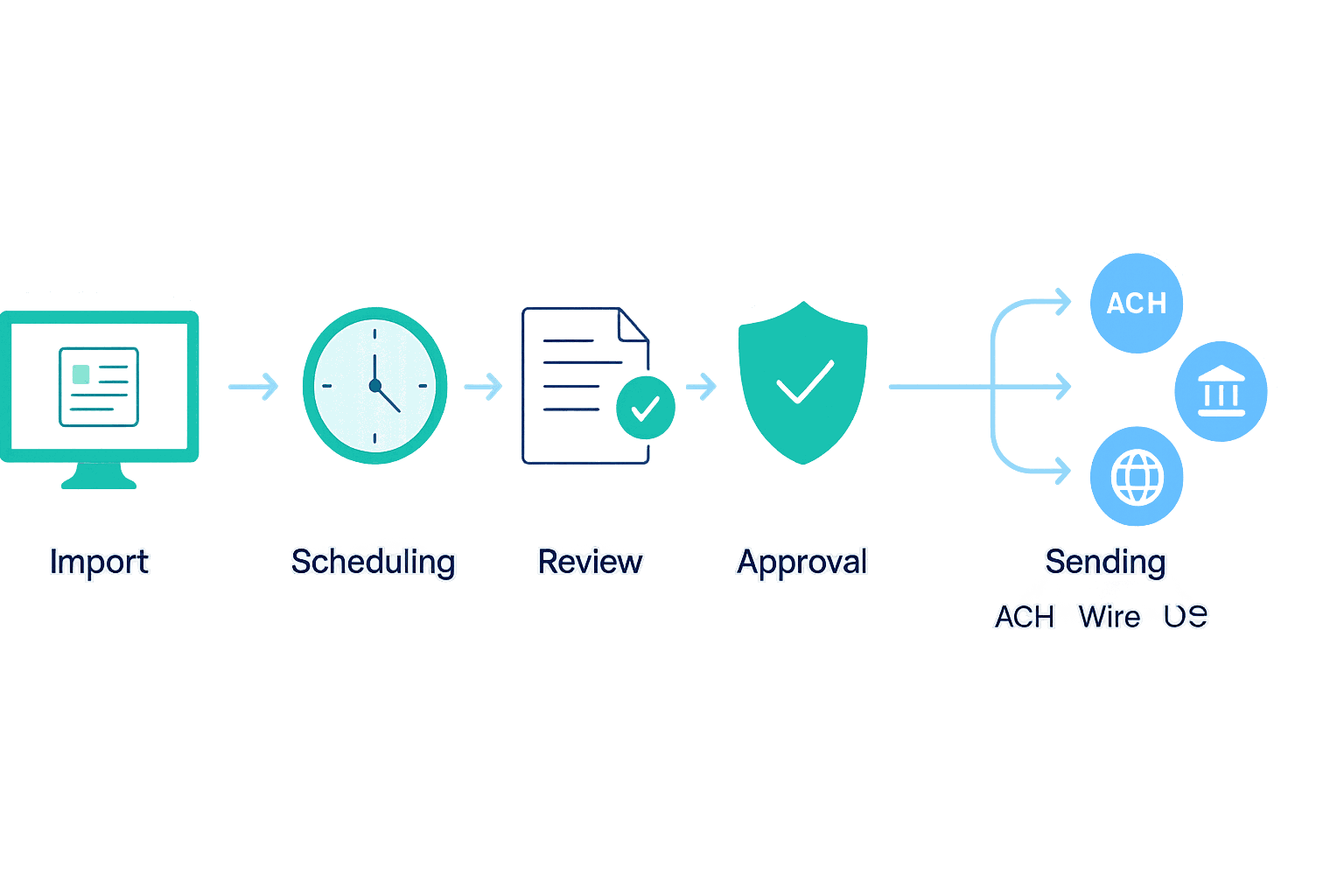

Put your AP on autopilot

Produce companies face constant pressure to pay vendors on time while managing perishable inventory and unpredictable cash flows. AP Automation from Reserva Pay eliminates manual invoice processing and late payments by automating the entire accounts payable workflow—from invoice capture to multi-level approvals and payment scheduling. Unlike legacy systems built for large corporations, our AP tools are simple and flexible, making them accessible for small to mid-sized produce businesses that need control without complexity.

Live payments from a single platform

Paying growers, freight companies, and suppliers—many across borders—requires speed, accuracy, and transparency. Reserva Pay supports multiple disbursement methods, including ACH, wire, and instant payments, giving produce companies the flexibility to meet each vendor’s preferred payment method while managing timing and cost. Where traditional payment solutions are built for banks or massive enterprises, we’ve tailored ours to support the fragmented, fast-paced produce supply chain—even for small shippers and distributors.

Payments

-

ACH transfers (standard and same-day) for U.S. domestic payouts

-

Domestic and international wire transfers with audit support

-

Instant payment support for time-sensitive transactions

-

Credit card disbursement support where applicable

-

Bulk payment processing for mass payouts with vendor mapping

Treasury

-

Real-time cash flow forecasting with predictive analytics

-

Integrated cash position monitoring across accounts

-

Liquidity planning tied to AP/AR cycles and vendor terms

-

Centralized view of all payables, receivables, and available capital

-

Configurable alerts for overdraft risk, funding needs, and liquidity gaps

The ONLY produce treasury solution

Cash is king in produce, and managing liquidity day to day is critical—especially when seasons, weather, and market conditions shift rapidly. Our Treasury tools give produce businesses real-time visibility into cash positions and cash flow forecasts, enabling smarter decisions about who to pay, when, and how. Whether you’re a large vertically integrated shipper or a startup wholesaler, our solution adapts to your scale while delivering insights typically reserved for enterprise finance teams.

Onboarding checklist, done.

Working with a rotating base of growers, logistics providers, and exporters means managing vendor data, compliance, and communications can be a full-time job. Reserva Pay simplifies vendor onboarding and management with self-service portals, PACA verification, and centralized vendor records. What’s normally a complex system requiring custom software is now available out of the box—even for small produce companies—helping you onboard vendors faster, stay compliant, and maintain strong relationships.

Vendor Management and Onboarding

-

Self-service vendor onboarding portal with document upload

-

Automated PACA license and tax ID verification

-

Configurable vendor approval workflows

-

Centralized vendor directory with payment history and contract links

-

Vendor communication tools (e.g., messaging, dispute resolution, notifications)

Foreign Exchange

-

Same-day payments in foreign currency (e.g., MXN, CAD)

-

Multi-currency account management (USD/MXN dual wallets)

-

Transparent and competitive exchange rate calculations

-

Pre-approved FX limits for recurring payables

-

FX exposure management and reporting

Fast, low cost payments.

Many produce businesses buy and sell across borders, often paying in foreign currencies and facing unpredictable bank fees or exchange rates. Reserva FX delivers fast, cost-effective international payments with transparent rates and same-day settlement—especially in key corridors like the U.S. to Mexico. While FX tools are often hidden behind enterprise platforms or bank portals, we’ve built ours into the workflow of even the smallest produce shippers and importers.

Leverage your customers' credit

Growers want to be paid quickly, but buyers need time to collect from their customers—this mismatch creates working capital strain. Reserva’s trade finance tools offer practical solutions: pay vendors early using AP credit, unlock cash from receivables, or use dynamic discounting to preserve relationships and reduce costs. These capabilities, once only available to Fortune 500 firms, are now built for small-to-midsize produce companies, enabling them to operate with the agility of much larger players.

Trade Finance

-

Dynamic discounting programs for early vendor payment

-

AP trade credit line to fund large or seasonal purchases

-

Invoice discounting for faster collections

-

Embedded financing offers during payment scheduling

-

Credit assessment tools integrated with onboarding

Compliance

-

Same-day payments in foreign currency (e.g., MXN, CAD)

-

Multi-currency account management (USD/MXN dual wallets)

-

Transparent and competitive exchange rate calculations

-

Pre-approved FX limits for recurring payables

-

FX exposure management and reporting

We help you stay compliant

From PACA Trust protections to audit trails and payment traceability, compliance in produce isn’t optional—it’s essential. Reserva Pay automates compliance controls that ensure every dollar is tracked and protected, giving you peace of mind and helping you avoid disputes. Whether you’re running a family-owned operation or scaling a multinational import/export business, our platform embeds the legal and financial safeguards you need, without the administrative burden.